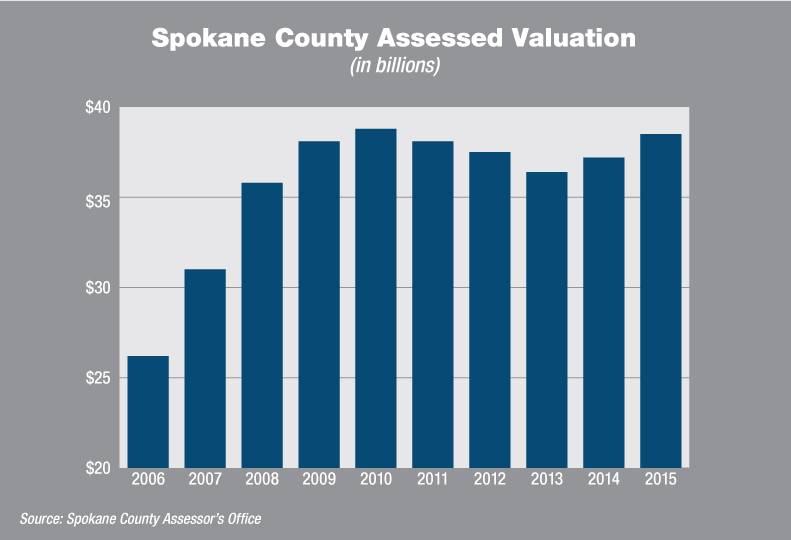

Below is a list of links to county property tax records in Washington. Building permits are issued by the Sweetwater County Planning and Zoning Office and the cities of Rock Springs and Green River.Records in your county are a great rsource for valuations and sales. The County Treasurer's Office is responsible for billing and collecting taxes. The voting taxpayers, county commissioners, state limitations, and assessed values determine the tax rate for each of the tax districts in Sweetwater County. s Office, located in Spokane, Washington, determines the value of all taxable property in Spokane County, WA. The assessor does not establish the dollar amount of taxes nor does the assessor bill or collect taxes. Market value has been defined by The Supreme Court as the sale price of real estate as agreed upon between a willing buyer and willing seller, with neither being under duress to. In addition, the Assessor’s Office maintains a property file and property card on every parcel of land that is not exempt. Spokane County Assessor establishes the true market value, also known as market value, for all taxable real properties within the county. The office also maintains property information including maps, legal descriptions, owner information, and improvement details. Spokane County has one of the highest median property taxes in the United States, and is ranked 506th of the 3143 counties. Spokane County collects, on average, 1.01 of a property's assessed fair market value as property tax. The assessor strives to value properties accurately, fairly, and uniformly according to guidelines from Wyoming Statutes and the Wyoming Department of Revenue. The median property tax in Spokane County, Washington is 1,901 per year for a home worth the median value of 187,900. The assessors are mandated and prescribed by state law on how and when assessments are performed. It is the statutory duty of the Assessor's Office to locate, identify, and value all taxable property ( real property, personal property and mobile homes) in Sweetwater County as of January 1 of each year. If you have any questions regarding the value of your property or the valuation process, the Assessor's Office is always ready to assist and serve you. We strive to provide accurate information and will always make the service we provide to the citizens of Sweetwater County our top priority. The goal of the Assessor's Office is to assist the taxpayer in an efficient, knowledgeable, and friendly manner. The total tax levy for 2013 is 501.8 million, up 1.4 percent from the 2012 tax year. Spokane Countys total assessed value in 2012 was 36.4 billion, down nearly 3 percent from a year earlier. Please check out the links on the left for more information. Meantime, the number of property owners who contested their assessments has dropped dramatically, says Spokane County Assessor Vicki Horton. This site has been prepared by the Sweetwater County Assessor's Office to help property owners better understand the functions of the Assessor's Office and provide information on what tax relief programs are available, how property tax is determined, how real property is assessed, what personal property a business should declare, and much more. With nearly 72 percent of the votes in the recent election, Republican Vicki Horton has four more years as Spokane County Assessorand a mandate to keep doing what she’s doing. Property owners filed 827 this year, down from 1,018 last year. In addition, our field inspection teams will not be going out to inspect property until we feel there is no danger to the public or our staff. Vicki Horton, recently re-elected as Spokane County Assessor, says the number of appeals filed with the office has declined.

We are here to serve our tax payers, but if we can provide the appropriate service by phone or email, that would be better for our employees and the tax payers in general. We would encourage all residents to call our office to confirm the “need” to come into the office in person. Businesses trying to send in personal property renditions can do that by regular mail or by email at Any general property questions may be answered by going to the Sweetwater County MapServer Current Sweetwater County veterans can renew their veteran’s exemption by calling our office at 30. In response to the current COVID 19 crisis, The Sweetwater County Assessor’s Office would like to take this opportunity to remind all Sweetwater County residents of the services that are available over the phone and through email. Register to Vote / See Election Results.Search Land Records Online - i-Doc Market.Emergency Management /Homeland Security.

Southwest Wyoming Regional Airport Board 1.Sweetwater Economic Development Coalition (SEDC).Fiber Optics Telecommunication Cooperative Joint Powers Board.District Board of Health (Public Health).Combined Communications Joint Powers Board.Southwest Wyoming Regional Airport Board.

0 kommentar(er)

0 kommentar(er)